At the point when Tayo Oviosu established Paga in mid 2009, he accepted cell phones could carry monetary administrations to all Africans.

It implied making a portable application, yet it was still early days in Nigeria’s monetary administrations industry, and KYC and recognizable proof systems were practically nonexistent. It constrained a shift in direction. Rather than an application, Paga sent off PoS frameworks that are currently very well known and is a conspicuous player in the monetary administrations space.

“Toward the finish of Walk 2024, we had handled 335 million exchanges since commencement, worth more than ₦14 trillion ($32 billion), and we did 80% of that over the most recent five years. This last quarter was our best quarter ever,” Oviosu said.

“Last year, we developed net benefits north of 200% year-on-year. Our Nigerian business was beneficial for the third year.”

Oviosu declined to share real productivity figures.

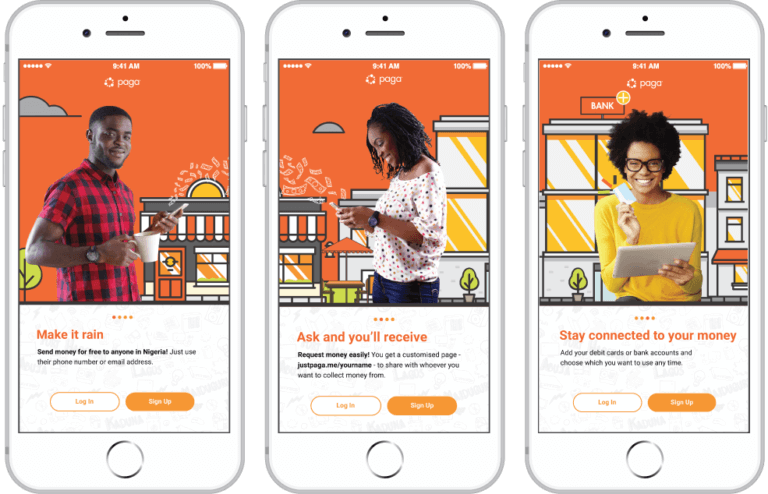

15 years and trillions of naira handled exchanges later, Paga is pulling together on a versatile application it originally sent off in 2020. The Paga application, which the organization says has 4.5 million clients (it didn’t uncover the quantity of dynamic clients), permits clients to make versatile records, cover bills, purchase broadcast appointment, and send cash.

The emphasis on a shopper fintech application comes as computerized installments is encountering hazardous development. In 2023, a not well considered money upgrade saw fintech new businesses process record volumes.

While a rising tide lifts all boats, it likewise makes contest and everybody needs to take part in the fintech activity. Nigeria’s greatest banks have drifted independent fintech items and very much supported new businesses Moniepoint and OPay have snatched a huge portion of the customer market.

“This isn’t a champ bring home all the glory market. There are various portions of the market that everybody is centered around.”

Oviosu accepts Opay is his most immediate rival, however explains that the two organizations have contrasting ways to deal with the market.

“Our essential objective is a marginally higher crowd than Opay’s, not to say we don’t have a covering crowd.”

Past market division, Paga’s center is conveying an unrivaled client experience.

“You won’t see a video saying individuals lost their cash in Paga. On the off chance that there is any issue, we’ll determine your concerns.”

Divercification is significant for Fintech new companies

Paga offers three administrations: organization banking; a wallet-as-a-administration that permits engineers to use the fintech’s wallet foundation, and the Paga portable application. With 50,000 specialists, Paga’s representative financial business is probable sizeable, however serious rivalry in the organization banking space and the dispersion of PoS which are vigorously sponsored comes down on working edges.

“Before organizations make to the point of recuperating the installments on the gadgets, individuals will begin dropping off. There is no dependability there.”

Oviosu accepts immersion in the space will kill off edges and predicts a go to tap-to-pay as the favored method for installment later on.

While the jury is still out on what the future will bring, the current issue in the monetary administrations space is the rising episodes of misrepresentation. Among April and June 2023, Nigerian monetary organizations lost ₦5.5 billion to fake credit accounts, per information from a FITC report.

These episodes are causing noticeable grating between customary banks and neobanks. Loyalty Bank — which lost ₦2 billion ($2.5 million) to extortion — confined moves to OPay, Kuda, Moniepoint, and Palmpay in October 2023. A few monetary administrations specialists frequently guarantee the KYC cycles of neobanks are careless and are effortlessly taken advantage of by troublemakers.

In December 2023, the controller made an appearance, normalizing KYC processes for neobanks and requiring distinguishing proof for all records.

“We settled on that choice with the CBN to counter extortion. We composed a whitepaper to the business: the banks, and portable cash suppliers, which prompted conversations that eventually formed the as of late reexamined CBN guideline.”

The conversations with controllers keep on being continuous, with a new mandate precluding neobanks from onboarding new clients as specialists get serious about crypto exchanging.

As Paga goes to the future, it intends to send off in another African nation and doesn’t like to be brought into discussions about an exit.

At the point when we press, Oviosu just offers that he lean towards an essential obtaining over an Initial public offering.

“I think the tensions of running a public organization are to such an extent that for the vast majority, it’s difficult to do that, despite everything adhere to the big picture approach.”

“I need to construct a multibillion-dollar business that is significant to another person to take and proceed with that vision.”